1099 ira distribution rollover box 2 You must report the receipt of a direct rollover from a qualified plan, section 403(b) plan, or governmental section 457(b) plan to an IRA. Report a direct rollover in box 2. For information on direct rollovers of eligible rollover distributions, see Direct Rollovers, earlier. $37.90

0 · ira rollover tax return

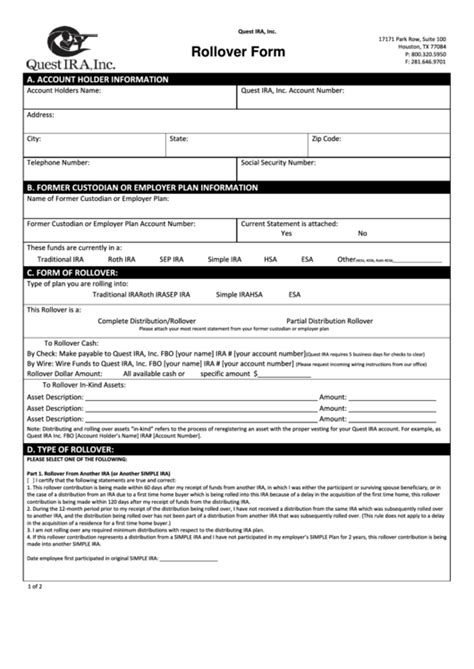

1 · ira rollover form

2 · ira rollover distribution guidelines

3 · ira rollover cost basis

4 · how to report ira rollover

5 · 1099 r with rollover

6 · 1099 r rollover vs distribution

7 · 1099 r ira distribution code

We offer high quality, premium grade metal wall vents and metal roof vents in copper, stainless steel, and galvanized. The heavier gauge of our products will last longer and can be used as .

You must report the receipt of a direct rollover from a qualified plan, section 403(b) plan, or governmental section 457(b) plan to an IRA. Report a direct rollover in box 2. For information on direct rollovers of eligible rollover distributions, see Direct Rollovers, earlier.File Form 1099-R for each person to whom you have made a designated distribution . Determine if you should report on your tax return assets (cash or property) moved from one IRA or retirement account to another.

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early . Since you took a distribution, and you rolled the balance into a ROTH the full amount in box 2 will be taxable. Now post your 1099-R as you have it including box 2. .Enter the Distribution Code in Box 7. If the taxpayer is under age 59-1/2 and Box 2a is more than zero, you will be queried if any exception to the 10% early withdrawal penalty applies. If no . There is no taxable income reported in Box 2. Now when I filed taxes with online version, it is correctly populating the rollover amount in box 5a on From 1040, but it is not .

Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount and it will have to be determined by the .

ira rollover tax return

Check out your 1099-R's gross distribution (box 1) and taxable amount (2a) from each of your retirement income sources. You'll likely need to copy over these amounts to their . I received 2 different 1099-R forms from taking my IRAs out of one bank and moving them to a credit union. I entered them into TT as directed, they show as earnings when . G (Direct rollover to another plan) H (Direct rollover to a Roth IRA) L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded .You must report the receipt of a direct rollover from a qualified plan, section 403(b) plan, or governmental section 457(b) plan to an IRA. Report a direct rollover in box 2. For information on direct rollovers of eligible rollover distributions, see Direct Rollovers, earlier.

Determine if you should report on your tax return assets (cash or property) moved from one IRA or retirement account to another.

ira rollover form

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax. Since you took a distribution, and you rolled the balance into a ROTH the full amount in box 2 will be taxable. Now post your 1099-R as you have it including box 2. Continue through the interview to Tell us if "You" moved the money through a rollover or conversion

Enter the Distribution Code in Box 7. If the taxpayer is under age 59-1/2 and Box 2a is more than zero, you will be queried if any exception to the 10% early withdrawal penalty applies. If no exception applies, select option 2, Transfer 1099-R Box 2a to Form 5329, Part 1, Line 1.

There is no taxable income reported in Box 2. Now when I filed taxes with online version, it is correctly populating the rollover amount in box 5a on From 1040, but it is not inserting a text comment "Rollover" next to it. Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount and it will have to be determined by the taxpayer. When this occurs, the first box in .

Check out your 1099-R's gross distribution (box 1) and taxable amount (2a) from each of your retirement income sources. You'll likely need to copy over these amounts to their relevant lines on Form 1040. I received 2 different 1099-R forms from taking my IRAs out of one bank and moving them to a credit union. I entered them into TT as directed, they show as earnings when they are actually a rollover with no distrubution. I entered code 7 in the first window and code G in the second, is this correct? G (Direct rollover to another plan) H (Direct rollover to a Roth IRA) L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after age 59 1/2. B (Designated Roth) DWC Notes: This includes RMDs.

sheet metal diagram

You must report the receipt of a direct rollover from a qualified plan, section 403(b) plan, or governmental section 457(b) plan to an IRA. Report a direct rollover in box 2. For information on direct rollovers of eligible rollover distributions, see Direct Rollovers, earlier. Determine if you should report on your tax return assets (cash or property) moved from one IRA or retirement account to another.

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax. Since you took a distribution, and you rolled the balance into a ROTH the full amount in box 2 will be taxable. Now post your 1099-R as you have it including box 2. Continue through the interview to Tell us if "You" moved the money through a rollover or conversionEnter the Distribution Code in Box 7. If the taxpayer is under age 59-1/2 and Box 2a is more than zero, you will be queried if any exception to the 10% early withdrawal penalty applies. If no exception applies, select option 2, Transfer 1099-R Box 2a to Form 5329, Part 1, Line 1.

There is no taxable income reported in Box 2. Now when I filed taxes with online version, it is correctly populating the rollover amount in box 5a on From 1040, but it is not inserting a text comment "Rollover" next to it. Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount and it will have to be determined by the taxpayer. When this occurs, the first box in . Check out your 1099-R's gross distribution (box 1) and taxable amount (2a) from each of your retirement income sources. You'll likely need to copy over these amounts to their relevant lines on Form 1040. I received 2 different 1099-R forms from taking my IRAs out of one bank and moving them to a credit union. I entered them into TT as directed, they show as earnings when they are actually a rollover with no distrubution. I entered code 7 in the first window and code G in the second, is this correct?

sheet metal drip edge

ira rollover distribution guidelines

The Haas VC Series VMCs combine the versatility of a small VF Series vertical machining center with the pallet-changing ability of our EC-400 HMC. The fully integrated pallet changer allows you to set up jobs on one pallet, while you’re running parts on the other pallet.

1099 ira distribution rollover box 2|ira rollover cost basis