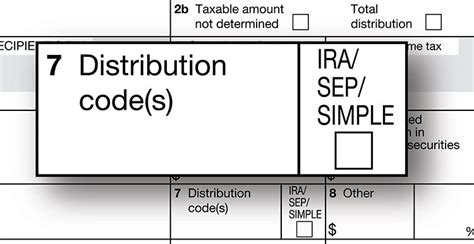

irs 1099 r box 7 distribution codes Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, . The typical switch loop wiring is to connect the switch cable white wire to all the black hot wires in the box. Then the switch cable black wire is connected to the fixture black wire. Finally, the fixture white wire is connected to all the white .

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

One of my kitchen sockets--or rather, the box to which it's attached--has begun to quietly beep, even when nothing is plugged in. The pattern is: 1 beep, silence, 2 beeps, silence. This cycle repeats about 28 times a minute.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code (s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, .

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

Form 1099-R Box 7 Distribution Codes. Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Additional information: Instructions for Forms 1099-R and .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .Box 7 is the distribution code, this describes the type of distribution the taxpayer took as known by the payer. The code will help to determine the taxability of the distribution. If the payer knows the distribution was a loan or a rollover, the .

Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non-taxable amount. Is this code G - Given in Box 7 Correct or should it be a different code like B ( rollover to Roth plan ?). Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D .

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

Form 1099-R Box 7 Distribution Codes: Overview. Form 1099-R is an IRS tax form used to report distributions from pensions, annuities, retirement plans, profit-sharing plans, and IRAs.Taxpayers who receive distributions from these sources during a tax year must report the income on their tax return.1099-R Codes for Box 7. Haga clic para español. Revised 01/2024. Box 7 Code. Description. Explanations . for information on distributions that may be subject to the 10% additional tax. A distribution from a qualified retirement plan after separation from service in or after the year the participant has reached age 55. You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. . My experience as a Tax Expert. When leaving 1099-R OPM box 2 blank it makes the customer get a higher refund. When box 2 is entered with box 1 info into TurboTax software it reduces the refund. If box 2 is not entered it will provide the taxpayer a .

amount will be shown in this box and code W will be shown in box 7. You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part. Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as n.Form 1099-R Box 7 Distribution Codes Are you filing a Form 1099-R for your client? . Annuity payments from nonqualified annuities and distributions from life insurance contracts that may be subject to tax under section 1411 (a distribution from any plan or arrangement not described in section 401(a), 403(a), 403(b), 408, 408A, or 457(b)).

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andamount will be shown in this box and code W will be shown in box 7. You need not report these amounts on your tax return. If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable death benefits that is taxable in part. The code P on the Form 1099-R 2020 will tell TurboTax to not include the distribution on the 2020 tax return. If taxes were withheld the TurboTax will carry the federal amount on line 25b on Form 1040 of your 2020 tax return and the state tax withheld will be carried to your state tax return. . 2020 1099-R Box 7 Code PJ - how to handle. The . The form provides information to the recipient and the IRS about the distributions made, which you would also use to report income on your individual tax return. Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a .

You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. A common compliance mistake occurs when financial organizations use the incorrect distribution code in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit .Internal Revenue Service Instructions for Forms 1099-R and 5498 Section references are to the Internal Revenue Code. What's New for 2001? Form 1099-R. Distribution codes for box 7 are in a chart format, Guide to Distribution Codes , on pages R-9 and R-10. Also, the following changes were made to the following distribution codes reported in box 7: Yes, the regular distribution of ,000 reported on the 2022 Form 1099-R code J will be entered on the 2022 tax return. Yes, the 2022 Form 1099-R with codes P and J for the 2021 excess contribution plus earnings will be entered on the 2021 tax return.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. . "IRA Contribution Information" where box 11 and 12 will be checked .You are not required to report this form to the IRS. In the .

In the follow-up to entering the code 2B Form 1099-R, you must indicate that the distribution is NOT from a Roth IRA. TurboTax needlessly asks this question which serves only as an opportunity to make a mistake in answering since code B already explicitly indicates that the distribution from a Designated Roth Account in a qualified retirement plan, not from a Roth IRA.

I agree, there should have been no code L1 2019 Form 1099-R since the loan was satisfied by the 2018 offset distribution reported on the code M1 2018 Form 1099-R and you had no loan in 2019 on which you could have defaulted in 2019. You need to obtain a corrected code L1 2019 Form 1099-R from the payer showing Nondisablity is just written on the form to by the agency providing the 1099-R. There is no code on a 1099-R for nondisabiltiy. You only enter the code in box 7a as is shown on your form. If the code is a 7 with the words Nondisabilty enter a 7 in box 7a. If the code is a 2 with the words Nondisabilty enter a 2 in box 7a. distributed. I received a 1099R with Box 7 containing codes D7. On source screen do I select "qualified IRA" or "None of the Above"? Also noted that when reviewing the screen, "None of the Above" is changed to " distribution before retirement". Is this normal? Review was made by going through update process, not. Content Submitted By Ascensus. One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following .The following are the instructions for the 1099-R, Box 7 data entry and what each code means. Codes. 8: Per IRS instructions, distributions with code . If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. . then only enter .

Loans treated as distributions. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a distribution and include all or part of Solved: My 1099 r box 7 shows distribution code 7- non disability which doesn 't match any of the codes. what should I use?

weld sheet metal to angle iron

We are a steel warehouse & aluminum distributor with over 30 years of experience serving Wichita Falls and surrounding areas.

irs 1099 r box 7 distribution codes|1099 r code 7 means